It’s tax season and you may be wondering if it makes sense for you to contribute to an IRA, an Individual Retirement Account. Good question, especially with the option to make a standard deduction, versus itemizing your deductions. Before we talk about the potential for a tax deduction, however, let’s look at your IRA choices. There are Traditional IRAs and Roth IRAs. Contributions for tax year 2021 to either type of IRA must be made by April 18, 2022.

How are Traditional IRAs and Roth IRAs the same?

Both a Traditional IRA and a Roth IRA are ways to save for retirement that give you tax advantages. IRAs are accounts that are set up through a financial institution by you, individually. They are similar to, but entirely separate from, retirement plan accounts available through your employer.

The word “individual” in IRA means that only one person can be an owner of an IRA. Therefore, husband and wife must open separate accounts. No matter which type of IRA you choose, you must have earned income, taxable compensation, to qualify to contribute to an IRA. If your spouse does not have earned income but you do, it is possible that he or she could also contribute to an IRA. To contribute, you must:

- Have taxable compensation, or

- Have a spouse with taxable compensation and file a joint tax return

Your taxable compensation must be greater than the amount of the combined contribution. If not, then the amount of the contribution must be reduced to the level of the combined taxable compensation. For example, if you are working part-time and your spouse is not working and your total taxable compensation is $5,000, then you can contribute up to $5,000 combined to the two IRAs. You can split the contribution between the two IRAs any way you want.

If one of your children has taxable income, he or she could open either a Traditional or a Roth Custodial IRA. The IRA is opened in the child’s name with an adult as custodian until he or she reaches the age of majority in your state, usually age 18 or 21. One of my clients had children who were actors, and each had reportable taxable compensation. We opened Custodial IRA accounts for each of them.

Annual contribution limits are the same for Traditional and Roth IRAs and they may change every year to keep up with inflation. The limit was $6,000 in 2021 and remains there for the 2022 tax year. There is an additional “catch-up” contribution allowed for those age 50 or over. In 2021 and 2022, the catch-up amount is $1,000; so those age 50 or older could contribute up to $7,000.

What are the differences between Traditional and Roth IRAs?

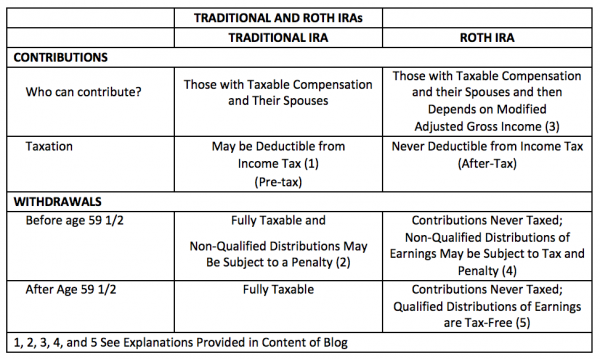

There are important differences between Traditional and Roth IRAs which have not only tax and penalty implications for your withdrawals, but also for the withdrawals of beneficiaries of your IRA.

Traditional IRA differences will be discussed first, but let’s start with an overview chart:

Traditional IRAs

Whether or not a contribution to a Traditional IRA is tax deductible depends on a couple of things. The deduction may be limited if you or your spouse are covered by a retirement plan at work and your income exceeds certain levels. Your deduction is allowed in full if you (and your spouse if you are married) aren’t covered by a retirement plan at work. If you, or your spouse if you are married, are covered by a retirement plan at work, the amount you can deduct may be limited by your income. Please refer to this IRS website for a chart of income limitations for every tax filing status: https://www.irs.gov/retirement-plans/plan-participant-employee/2022-ira-contribution-and-deduction-limits-effect-of-modified-agi-on-deductible-contributions-if-you-are-covered-by-a-retirement-plan-at-work.

The good news is this: even if you choose to take the standard deduction when you file your federal income tax (you do not itemize), you may take a deduction, if you qualify, for a Traditional IRA contribution.

If you do not qualify for a deductible contribution to a Traditional IRA, you may still make a full contribution. The portion that is not deductible is called an “after-tax” contribution and you, the taxpayer, are required to keep records of how much you contribute to your Traditional IRA that is pre-tax and how much is after-tax so when you make a withdrawal, income taxation will be prorated. However, if you can’t deduct your contribution, consider a contribution to a Roth IRA instead.

Now let’s look at the rules for withdrawals from a Traditional IRA. We will assume that you were able to fully deduct your contribution so that any withdrawal—contributions, any growth, and earnings—is fully taxable. All are considered ordinary income.

IRS rules include penalties if you take distributions from an IRA before age 59 1/2, but different rules apply once you pass this age. Withdrawals before age 59 1/2 are nonqualified and normally carry a 10 percent penalty. If you withdraw before age 59½, a 10% penalty will apply unless it is for a qualifying reason such as unreimbursed medical expenses, high education expenses, first-time home purchase (up to $10,000), and qualified birth or adoption expenses. For a full list of qualifying reasons, please refer to: https://www.irs.gov/taxtopics/tc557.

Between ages 59 1/2 and 72 (formerly 70½), there are no requirements on the size or timing of withdrawals from a traditional IRA. You can take out as much as you want whenever you want. Between those ages, all distributions are penalty-free, qualified distributions. But retirement distributions from a traditional IRA are subject to federal income taxes and may also be taxed by your state. When you reach age 72 (formerly 70½), mandatory minimum withdrawals are required. Required minimum distributions (RMDs) will be covered in a coming blog.

Roth IRAs

All contributions to a Roth IRA are after-tax. No federal income tax deduction is allowed. However, not everyone is allowed to contribute to a Roth IRA. As with Traditional IRAs, you or your spouse must have earned income of at least the amount that you contribute. There is another restriction with Roth IRAs, however—your Modified Adjusted Gross Income (MAGI).

If you file taxes for 2021 as married filing jointly, you can’t contribute to a Roth IRA for 2021 if your MAGI is $208,000 or over; you can partially contribute if your MAGI is between $198,000 and $208,000; and you can fully contribute if your MAGI is at or below $198,000. For a single person the cutoffs are as follows: no contribution at or over $140,000 MAGI; partial between $125,000 and $140,000; full contribution at or below $125,000. A chart for every tax filing status is available here: https://www.irs.gov/retirement-plans/amount-of-roth-ira-contributions-that-you-can-make-for-2021.

Once the contribution is made, Traditional IRAs and Roth IRAs are the same—all funds in the account grow tax-deferred. That means you do not pay tax on any dividends, interest, or capital gains while the funds are in the IRA. The best part of a Roth IRA: since the contributions were made from after-tax funds, withdrawals from a Roth IRA, unlike a Traditional IRA, may be tax free. (The IRS calls the total amount of after-tax contributions to an IRA account “basis”.)

All Roth contributions, the basis, may be withdrawn from a Roth IRA for any reason and at any time without tax or penalty. That’s because you make contributions with after-tax dollars, so you’ve already paid income taxes on that money. Withdrawals of earnings work differently. Distributions of earnings may be subject to income taxes and a 10% penalty, depending on your age and how long since you made your first contribution to a Roth IRA.

In general, you can withdraw your earnings without owing taxes or penalties (the distribution is considered qualified) if:

- You are at least 59½ years old, AND

- It’s been at least 5 years since you first contributed to a Roth IRA

The latter is called the five-year rule and it applies no matter your age when you make your first contribution to a Roth IRA. Here are some examples:

- You opened a Roth IRA three years ago at age 25 and contributed to it annually but have now decided to use that money—all of it— to pay for a trip to Europe. (What are you thinking? This money is meant for retirement!) You may pay tax on the portion of the withdrawal that is earnings (taxed as ordinary income) plus a 10% penalty. (Remember, there is no tax or penalty on the contribution amount, your basis.) The penalty applies because the distribution is not qualified. You are younger than 59 ½ and the funds are not going to be used for one of the qualifying penalty exceptions which are the same as for Traditional IRAs. Again, a list of penalty free exceptions can be found here: https://www.irs.gov/taxtopics/tc557. Also, it has not been five years since you first contributed to your Roth IRA.

- Let’s say you are now 55 and between your trip to Europe and now, you contributed annually to your Roth IRA. (Way to go!) You may withdraw up to the amount of your total contributions, the basis, at any time without paying income tax or a penalty. Contributions always come out first and are tax-free. If you choose to withdraw more than the basis, the earnings portion may be subject to taxation and penalty. Although your first contribution to your Roth IRA was over five years ago, you are younger than 59½. In addition to checking for a penalty free exception, the IRS has a tool to determine if your withdrawal is subject to income taxation. See: Is the Distribution from My Roth Account Taxable?

- A friend of yours who is 56 just opened and contributed to a Roth IRA for the first time. When she turns 59½ she has met the age requirement but not the five-year rule. Earnings distributions from a Roth account open less than five years are considered nonqualified; they may be subject to penalties, no matter your age.

For the five-year rule, the clock starts ticking on January 1 of the year you make your first contribution to a Roth IRA. Because you have until April 15 of the following tax year to contribute, your five years might not be a full five calendar years.

I will cover the basics of Roth Conversions (it’s too late to do a conversion for tax year 2021 as conversions must be completed by calendar year end), required minimum distributions, and beneficiary designations in future blogs.

I hope this helps with your decisions about contributions to an IRA. If you have questions about either penalties or taxation of your withdrawal, please contact a tax professional or use the tools on the IRS website.

Thanks!

~Beverly J Bowers, CFP®