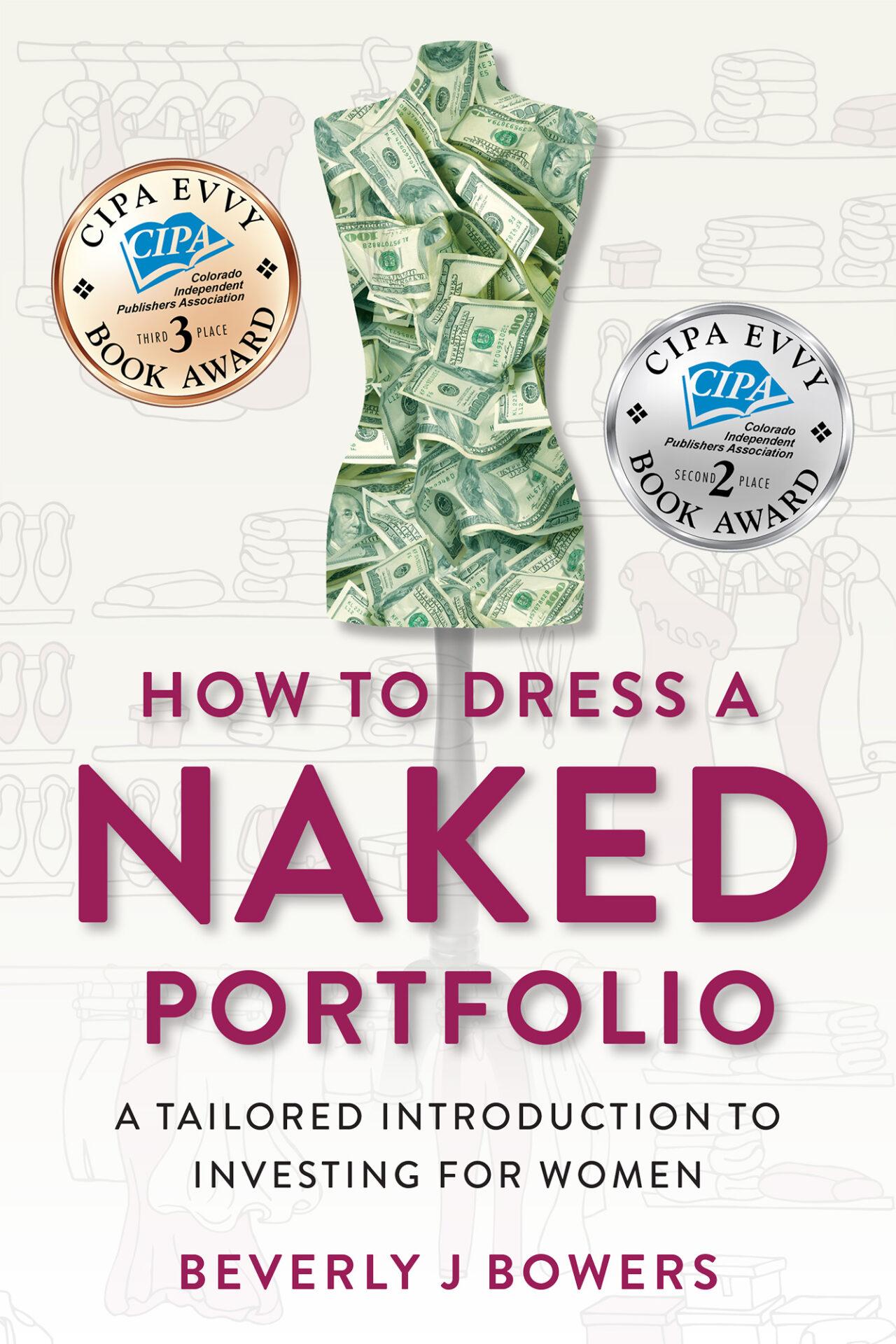

How to Dress a Naked Portfolio

Today’s women are stretched thin, like well-worn fabric. They are at a disadvantage with time, energy, and financial resources, even more so after the COVID-19 pandemic. Not only do women face a gap in lifetime earnings and retirement savings, but the financial savings confidence of women is lower than men—and the gap widened during the pandemic.

Think of investments—savings accounts, CDs, stocks, bonds, mutual funds—as clothes to hang in your investment closet.

Is your closet bare, and you don’t know what to buy or where to shop?

Maybe your closet is packed with investment clothes, but you are not sure if they go together, or if they are right for you?

Are you somewhere in between—you’re pretty sure you’re on the right track, but want another perspective?

How to Dress a Naked Portfolio: A Tailored Introduction to Investing for Women* focuses on beginner investors. This step-by-step guide for women starts with eight questions and only you know the correct answers. Your personality, values, income, and family circumstances shape all your life decisions and investing is no different. Using understandable comparisons, you will put together an investment outfit, piece by piece. The result will be both beautiful and uniquely you!

*A portion of book proceeds will go toward financial education for women.

Friends and family enjoyed my book launch party click here for photos of the event.

How to Dress a Naked Portfolio

Today’s women are stretched thin, like well-worn fabric. They are at a disadvantage with time, energy, and financial resources, even more so after the COVID-19 pandemic. Not only do women face a gap in lifetime earnings and retirement savings, but the financial savings confidence of women is lower than men—and the gap widened during the pandemic.

Think of investments—savings accounts, CDs, stocks, bonds, mutual funds—as clothes to hang in your investment closet.

Is your closet bare, and you don’t know what to buy or where to shop?

Maybe your closet is packed with investment clothes, but you are not sure if they go together, or if they are right for you?

Are you somewhere in between—you’re pretty sure you’re on the right track, but want another perspective?

How to Dress a Naked Portfolio: A Tailored Introduction to Investing for Women* focuses on beginner investors. This step-by-step guide for women starts with eight questions and only you know the correct answers. Your personality, values, income, and family circumstances shape all your life decisions and investing is no different. Using understandable comparisons, you will put together an investment outfit, piece by piece. The result will be both beautiful and uniquely you!

*A portion of book proceeds will go toward financial education for women.

WINNER: NON-FICTION - INVESTING

The annual Best Indie Book Award® (or BIBA®) is an international literary awards contest recognizing self-published and independently published authors from all over the world. Entries are limited to independently (indie) published books, including those from small presses, e-book publishers, and self-published authors.

Writer's Digest Competitions

”Congratulations on writing and publishing your book! ….. your overarching analogy of clothes and closet paired with finances and investments is unique and appealing. This is an extremely well written guide for beginners as well as anyone needing a refresher. You have written incredibly helpful and succinct chapters: your prose has no fat and you put everything into clear, relatable language. The further I got into the book, the more the clothes/closet metaphor was both illustrative and enjoyable. The chapter on Advisors was especially enlightening…... The Review and self-assessment exercises at the end of each chapter are great ways to make your points even easier to understand and applicable to every reader’s own situation.”

Judge, 30th Annual Writer’s Digest Self-Published Book Awards

CIPA EVVY 2022 Book Award

2ND PLACE - SELF HELP

3RD PLACE - BUSINESS

Each year, the EVVY Awards recognize excellence in independently published books. The CIPA EVVYs™ is one of the longest-running book award competitions on the Indie publishing scene, running for nearly 28 years. The annual contest is sponsored by the Colorado Independent Publishers Association (CIPA), along with the CIPA Education and Literacy Foundation (ELF). The EVVY Awards are judged by a 3rd-party panel of professionals on a qualitative scale of merit in nineteen different categories.

In an industry rife with financial jargon, How to Dress a Naked Portfolio helps to make investing seem approachable to those looking for answers. This book offers a quite readable introduction to investing concepts. It also provides needed guidance for building a personal financial framework for goal setting, budgeting, and saving. My hope is that resources like these will engage more women to feel empowered to learn, and confident to take a more active role in shaping their financial futures, in style!

~ J.S., Financial Advisor

At age 33, I can honestly say that despite my bachelor's degree and over 12 years in a professional business setting, this book unlocked concepts and subsequent knowledge that I shied away from in the past. Lack of familiarity with any subject can be daunting when faced with it, but obstacles are less challenging as knowledge is gained. Bowers excels in making subjects such as identifying goals, various investment strategies, risk management, and financial terminology accessible to the reader. Her analogies and inclusions of Bowers' own professional life as an investment advisor, wealth manager, and financial planner make the book's contents both relatable and friendly. I wish I could return to my high school years and present a copy to my 18-year-old self.

~ Rebecca Warren

This should be on every grandparent’s gift list for the graduating high school student!

~ Victoria M., MBA

When I needed help to understand financial concepts I was referred to Bev. She was very helpful, explained things very clearly, and was able to answer my very unprofessional questions. She is a great asset.

~ Helen R.

I think this book is relevant for any woman (or man, for that matter) dealing with or thinking she might be dealing with money - not just high school and college students. I learned from it and I am 82.

~Shirley K.

Start investing today

Sign up to download my FREE guide, The 8 Essential Investing Questions.

Join my email list - your information will never be shared.

Bev's Basics

CHEERS FOR THE FUTURE OF CHARITABLE GIVING

As a retired financial planner, I admit that my favorite clients were those whose goals included generous charitable giving. One couple comes to mind. Not only did they make generous donations to their alma mater and favorite non-profits, but they also invested in community efforts to improve blighted areas. Their life purpose was passed along […]

GIRL MATH

Girl math? Sounds sexist to me! I am told it is a new descriptive phenomenon inundating TikTok and other social media. Here’s how a TikTok user explained girl math: You’re losing money if you don’t purchase something when it’s on sale. You’re losing money if you don’t spend enough to qualify for free shipping. You’re […]

FINANCIAL LOVE

This is the time of year we focus on those we love. Children share valentines in school, heart-shaped boxes full of candy disappear from the shelves, florists run out of red roses, and jewelry stores appeal to lovers of any age. There is a special focus on couples and ways to express the love they […]

Send me your questions

It is my goal to help you understand the financial world. There is no question that is too basic or simple.