First, a quick review of bonds in general. You might want to refer to my blog, Asset Allocation = Investment Chili. In that blog, I talked about taxable bonds—those issued by corporations to fund operations, research, or capital improvements.

Bond Review

Bonds represent debt, an IOU, or a loan. When you own a bond, you are a lender. The example used in the above blog was the following: Intel wants to build a new factory in the U.S. They could go to their bank or other financial partners to borrow the money, but one of their choices for financing is to go directly to the public. Why would they choose to do that? The reasons may be multiple, but an important one is that they could borrow money from the public and pay a lower rate of interest than they would borrowing from their other options. They borrow directly from the public by issuing bonds. You and many other potential lenders then have the option to lend Intel some money if you want. Let’s say you decide to lend Intel $5,000 and buy a bond at par (par means you pay 100% of the face value). During the time Intel has the use of your money, they will pay you interest, usually semi-annually, based on $5,000. Plus, at a designated time in the future, Intel will return the money, the $5,000, they borrowed from you. That is an example of a corporate bond, one issued by a corporation and the interest you receive is taxable at both federal and state levels.

Municipal Bonds

Another type of bond is a municipal bond. It is a debt obligation of a state or local government or entities they create such as authorities and special districts. The funds may be used for general government needs or special projects. You probably have voted to approve/not approve bond issues of school districts, cities, counties, or states. Municipalities often borrow money from the public for capital improvements—a new elementary school or improvements to the sewer system, for example. Often called “munis,” municipal bonds may also be issued to help pay for public works projects such as new roads, hospitals, or stadiums.

Types of Municipal Bonds

There are three types of municipal bonds. One of the most common types is called a general obligation bond. The municipality generally repays them by using tax revenues or money from the general account, and they are not backed by a specific asset or project that will produce revenue. General obligation bonds are backed by the “full faith and credit” of a government entity to tax and borrow. Therefore, the credit quality of a general obligation bond will be dependent on the municipality’s taxation history and its history of financial management, among other factors.

Revenue bonds are the most common type of municipal bonds. There are almost twice as many revenue bonds in existence today than there are general obligation bonds if you compare total market value. Revenue bonds are repaid with proceeds, the revenue, generated by the project—toll highways, water or sewer systems, or sports arenas, for example.

The third type of municipal bond is a private-purpose bond. It uses most of its funding to benefit private, non-public activities or private parties. They include non-profit colleges and hospitals. If 10% or more of the money raised benefits a private entity, it is a private-purpose bond. Municipalities often issue private-purpose bonds because they believe the investment it funds will stimulate the local economy. That is often the case for industrial-development bonds, for example. Although the company’s products may not be of particular social significance, the jobs the manufacturing plant generates benefit the community. Income from private-purpose bonds is usually taxable, unlike other municipal bonds.

Credit Quality

Think about your own credit score. Credit scores and credit ratings are similar. Companies use credit scores (ranging from 300 to 850) to assess people’s ability and willingness to make car or mortgage payments. Investors in municipal bonds use credit ratings to assess creditworthiness, or the ability and willingness of the state or local government issuing the bond to pay investors their money back, plus interest. Bond issuers typically pay for a credit rating to enhance sales, however not every bond issue has a credit rating. Some bond issues are just too small to warrant the expense, for example.

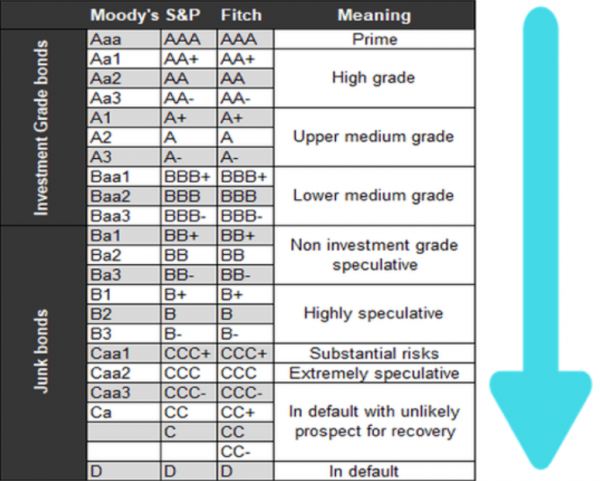

The highest credit quality rating is AAA and the lowest is D (in default). Here is a credit quality chart.

Why is a credit rating valuable? For a bondholder, the higher the credit rating, the higher the probability you will be repaid. That means less risk. By reading my blogs, you know that lower risk typically means a lower rate of return. In general, you can expect the higher the credit quality of the bond issue, the lower the interest rate it will pay bond holders. That is a plus for the bond issuer because it lowers their cost.

Another way for municipal bond issuers to increase the credit rating of their issue and, hopefully, attract more bondholders, is through the purchase of bond insurance through a private insurance company. The insurer guarantees scheduled payments of interest and principal on a bond in the event of a payment default by the issuer. It is a form of “credit enhancement” that generally results in the rating of the insured security being higher.

Advantage of Municipal Bonds

The biggest advantage to municipal bonds, except for private-purpose bonds, is that interest earned from municipal bonds is generally not subject to federal tax. In addition, they are often exempt from state and local taxes if certain requirements are met. For instance, being a resident of a certain city or state for a specified number of years could be a determining factor. As mentioned above, however, private-purpose bonds have different taxation rules. In general, they are fully taxable unless specifically exempted.

As a result of the tax benefit, municipal bonds usually carry lower interest rates than taxable bonds. Therefore, municipal bonds make the most sense for those in higher tax brackets who can reap the after-tax benefit of the tax-free income. There is a calculation a bond specialist makes for a potential buyer to compare the yield of a taxable bond to the yield of a tax-free municipal bond to determine, on an apples-to-apples basis, which one will give the buyer a higher return. The calculation uses your income tax bracket so it is specific to you.

How do bonds add value to your portfolio? Although the price of bonds fluctuates, the degree of fluctuation, or volatility, is usually less than stock, and therefore bonds are considered a more conservative part of your asset allocation. There is also more certainty with bonds than with stocks. Unless the issuer experiences financial problems, you can expect to receive regular interest payments and the return of your principal at maturity.

You can buy municipal bonds from a registered municipal bond dealer through the same account that holds your other financial assets, a taxable brokerage account, for example. But, only in rare situations would you want to buy a municipal bond in a tax-deferred account such as an IRA or a 401(k). There is no extra benefit for tax-free income in a tax-deferred account. In some cases, you can buy bonds directly from a municipality. You can also own bonds indirectly through a municipal bond mutual fund or exchange-traded fund.

This blog covers only the basics of the many nuances of municipal bonds. It would be in your best interest to discuss the advantages and disadvantages with a professional who understands your financial situation and who is a municipal bond specialist.

~Beverly J Bowers, CFP®