I just opened a local magazine and came across an editorial with this focus: rest is productive. Boy, did I need to be reminded of that!

Today is not a good day. I feel overwhelmed with all the tasks associated with marketing my recently published book along with getting ready for the holidays and six December family birthdays. I just want to yell, STOP!!!! I know that all the shopping will get done and packages wrapped and mailed, and cookies baked and …. on and on. But I need a break! How about you? Could you use a break, too?

Take a Break

Maybe sit down with a friend for a sappy holiday movie with some popcorn, or cruise around to see lights on houses, or just sit with a book and cocoa or apple cider with a little spiced rum. That’s my favorite! Maybe watching sports is your escape or hitting the gym or going for a long walk or playing a video game or meditating. Shut out all the bustle and just chill. We all need to take breaks!

Do you know that even your portfolio needs a break? It is tiring and even counterproductive to watch your investments every day. Too much attention may lead to overtrading with surprising tax consequences. I assume you knew the market goes up and down when you first started investing. The ups and downs, also called volatility, continue to increase so it can scare a person who follows those moves closely. Some people panic and sell, and then costly mistakes could result.

Think about the changes you have seen in your lifetime. News is distributed and almost immediately it is picked up by hundreds, even thousands, of people. We now know what is happening in China or Russia or South America almost as soon as it occurs. You can follow your favorite sports figure or actor or actress and find news about them all day long. As hard as I try, I find it impossible to keep up with my saved file of articles important to my field, let alone what is happening in the world. There is so much information! How do you know where to focus and what is truly important? What is a conscientious investor to do?

The scary thing for an investor is that the market reacts to many, many pieces of news, both national and international news. It also reflects expectations of what will happen in the future. For example, will Congress pass a certain tax law? How will the newest variant of COVID affect employment and company profits? What will China do next to assure its place in the world? Each piece of news could, and sometimes does, move the market. Up and down, up and down.

Investing is for the Long Term

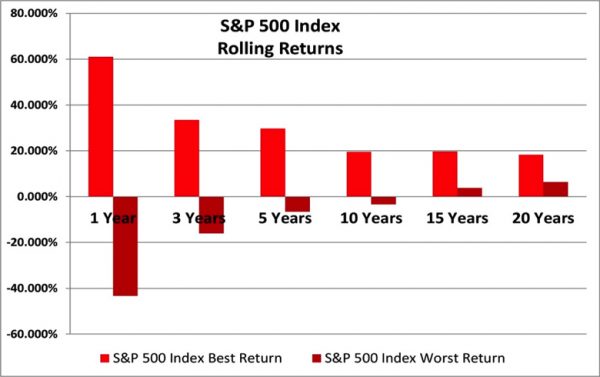

If you follow my blogs, then you know that investing is for long-term goals—those that are five years or longer until the money is needed. Why do you feel it necessary to watch the growth, or decline, every day? If you plant a seed in your garden or flowerpot, do you dig it up every day to see what has happened? No. You trust the process. That is the same with investing. The longer you keep your money invested, the better its possibility for growth. The chart that follows demonstrates over time, despite any yearly gyrations, the stock market has a history of positive results. It uses the S&P 500 Index as a proxy for the stock market.

Over short time periods, the S&P 500 Index has delivered both very high returns and very low returns. The chart looks at the one, three, five, ten, fifteen, and twenty-year rolling returns of the S&P 500 Index over the forty-year period of January 1979 through December 2019, as an example. Rolling returns do not go by the calendar year; instead, they look at every one-year, three-year, five-year, etc., period beginning anew each month over the historical time frame selected. Rolling returns give you a picture of how the stock market performs over both good and bad times. You don’t get the complete picture when you only look at average returns because the average smooths out the ups and downs.

Source: Anspach, Dana, Control Your Retirement Destiny: Achieving Financial Security Before The Big Transition. Fort Collins, CO, A Book’s Mind, 2016. Chart updated by, and used with permission of, author. Past performance is no guarantee of future results.

During the period of January 1979 through December 2019 in the graph, the worst one-year rolling time frame delivered a return of -43%. That occurred over the twelve months ending in February 2009. The best one-year index return delivered a positive 61% return, which occurred over the twelve months ending in June 1983. Huge swings can occur over relatively short time frames.

Using the same historical time frame, if you were a long-term investor, the worst twenty years delivered a return of positive 5.6% a year. That occurred over the twenty years ending in December 2019. The best twenty years delivered a return of positive 18% a year, which occurred over the twenty years ending in March 2000. Both the best and worst twenty-year rolling returns were positive. What does that indicate? The longer you can stay invested, the greater the possibility of a positive return. There is no guarantee, of course, but you increase your chances if you keep your investments in place for as long as possible.

When should I make a change?

There are times when you should make changes in your investments or to the mix of stock and bonds, however. I take a portfolio deep dive twice a year, but once a year may be enough for some people. If the market makes a major move or if life circumstances change (divorce, marriage, new child, retirement, death of a spouse/partner), do a major analysis as soon as possible. Please refer to my blog, The Key to Investing – Know Yourself, for more information about assessing and changing your asset allocation, the mix of your investments.

What should you look for? After assessing the mix of stocks and bonds that matches your risk tolerance, make sure your portfolio matches the suggested mix. After you bring your portfolio to its target allocation either initially or with an annual review (the latter is called rebalancing), then look at the performance of each security or mutual fund or exchange-traded fund (ETF). How does each compare to the index for that part of the market? For example, how did the return of your large company ETF compare to its benchmark, the S&P 500 Index, for example? Remember that the expenses of running a mutual fund or ETF will cause its return to be lower than the index in most cases, but it should not be too far off the mark.

There are lots of online sites to help with your analysis beginning with where you are invested. If your investment account is at Fidelity, for example, their website and statements contain lots of great information to help. You can even sign up on some sites for regular review reports in addition to account statements. Just before the end of the year is a good time to look at your portfolio for several reasons.

Not only do you want to start the new year with a portfolio that is balanced correctly for your risk tolerance, but also it is a good time to assess taxes so there are no surprises when you file. Did you make trades in your taxable account(s) during the past year that generated capital gains? That should be reflected on your account statement or on the website. Although capital gains are taxed at a lower rate if you held the security for more than one year, you still have time to look for losses in your account to offset the gain if you want to reduce the tax bite. Selling security positions at a loss to offset a capital gain is call tax loss harvesting.

Other Year End Assessments

The end of the year is also a good time to make sure that you are on track for contributions to your company retirement plan and any individual IRAs. Although individual IRA contributions can usually be made until tax filing time and some may be tax deductible, it is important to know where you stand (https://www.nerdwallet.com/article/investing/traditional-ira-rules ), and a quick assessment of potential income tax liability may help.

Before the end of each calendar year, I add up my income and deduct either the standard deduction or the expenses I know that I can deduct if I itemize—home mortgage, charitable contributions, medical expenses over a certain amount, etc. I then use the federal tax tables to compute the approximate tax due and compare it to the federal income taxes I withheld. Although it will not be exact, it gives me a ballpark idea of what my federal tax return will look like. Will I end up paying more in taxes, come out even (my goal), or get a refund? That allows me to do some adjusting before the end of the calendar year if necessary.

Some years I make additional contributions to non-profits to add to my itemized deductions. That is also when tax-deductible IRA contributions may help. On the other hand, some years I need additional funds for taxes and set up a schedule to set the money aside over the next few months.

If your tax bill will be substantial and you are the type of person who likes to support various charitable groups, consider opening a donor advised fund. According to the IRS, “a donor advised fund is a separately identified fund or account that is maintained and operated by a section 501(c)(3) organization, which is called a sponsoring organization. Each account is composed of contributions made by individual donors. Once the donor makes the contribution, the organization has legal control over it. However, the donor, or the donor’s representative, retains advisory privileges with respect to the distribution of funds and the investment of assets in the account.” If you and your tax advisor think it would be beneficial to bunch your charitable contributions this year, then consider a donor advised fund. The charitable deduction is made in the year of the contribution but the distribution of funds to the charities you choose can take place over many years. Some communities have a donor advised fund sponsoring organization but your broker-dealer—Fidelity or Schwab for example—may also. (Note: You may not take a distribution from an IRA directly to a donor advised fund.)

On the other side of the coin, if you have room to pay additional income tax without placing a burden on your family, you might consider converting all or part of your Traditional IRA to a Roth IRA. That is called a Roth conversion and the deadline for a conversion is the end of the calendar year. When you convert from a traditional IRA, whose contributions are generally pre-tax, to a Roth IRA, which always holds after-tax money, you must pay income tax on the market value of the converted amount. That could be a heavy tax hit, but you could instead choose to convert in pieces over several years. The advantage of a Roth IRA is that distributions are tax-free, with a couple of stipulations, and there are no required minimum distributions. Especially if you project that you will be in a higher income tax bracket in retirement, consider a Roth conversion. By the way, unlike Roth IRA contributions, there are no restrictions on Roth conversions for high income filers.

Older taxpayers, those 72 or over (70½ if you reach 70½ before January 1, 2020), must take a required minimum distribution from their retirement accounts—Traditional IRAs and employer sponsored plans such as 401(k)s, 403(b)s, etc.— by December 31st. If this is the year you turned 72, then you have until April 1st next year to take your first distribution, but then you must take another distribution before the end of the year—two distributions in that year. After that, the RMD deadline is the end of each calendar year or December 31st. There is no longer a RMD waiver and there is a hefty 50% penalty if you do not take your distribution. If you are not sure what you need to withdraw as a required minimum distribution, contact your financial institution or the custodian of your account.

Whew! Just when I said that you should relax and take a break, there seems so much to do. Not all the items mentioned will apply to you, however, and I have a feeling that taking a break for a few hours will not make a huge difference in your financial success. In fact, you may just come away with renewed energy! So, give yourself the time you need to recharge and your portfolio the time it needs to grow.

Until next week,

~Bev Bowers, CFP®